Understanding the Decline of Mortgage Rates

Oriana Suarez January 4, 2024

Buyers

Oriana Suarez January 4, 2024

Buyers

Understanding the intricate dance between inflation, the Federal Reserve (the Fed), and your homebuying plans is essential when navigating the housing market. Let's delve into the factors influencing these dynamics and explore how they might shape the trajectory of mortgage rates.

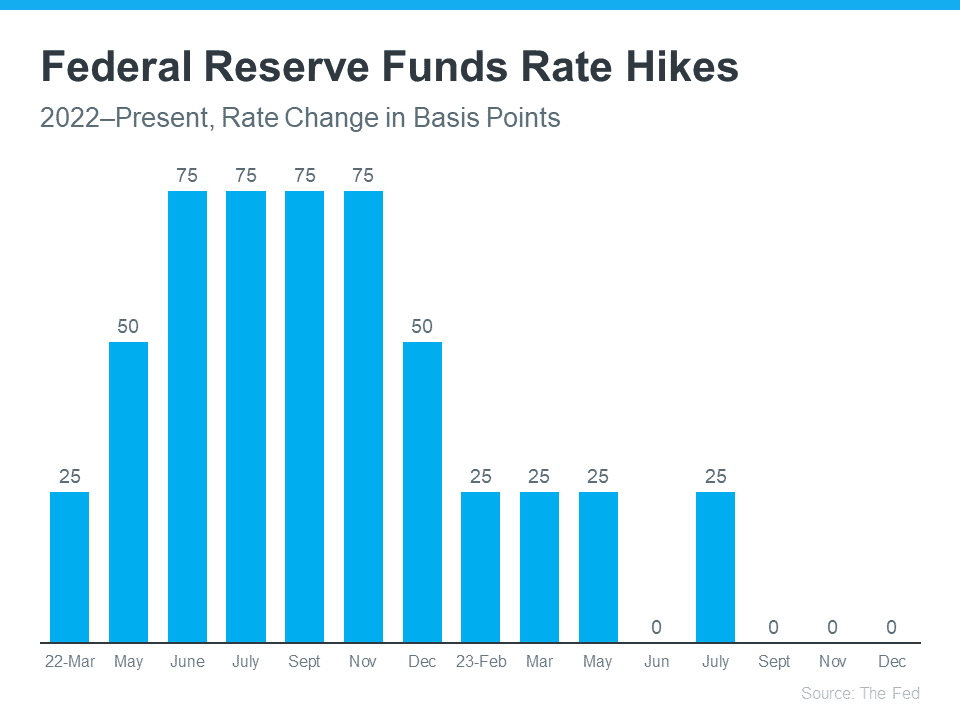

As a key player in controlling inflation, the Fed initiated Federal Funds Rate hikes to temper economic activity. While this doesn't dictate mortgage rates directly, it exerts influence. Recent signs of cooling inflation prompted the Fed to reduce the intensity and frequency of their hikes.

Recently, there have been no rate increases, and indications from the New York Times suggest potential rate cuts in 2024. This shift reflects the Fed's confidence in an improving economy and decreasing inflation, signaling a potential impact on mortgage rates. In fact, there haven’t been any increases since July (see graph below):

“Federal Reserve officials left interest rates unchanged in their final policy decision of 2023 and forecast that they will cut borrowing costs three times in the coming year, a sign that the central bank is shifting toward the next phase in its fight against rapid inflation.”

The complex interplay of factors, including inflation and the Fed's actions, significantly influences mortgage rates. Now that the Fed has paused the increases, it looks more likely mortgage rates will continue their downward trend (see graph below):

While some volatility may persist, recent trends, coupled with expert forecasts, suggest a potential continuation of declining rates into 2024. This trend not only enhances affordability for buyers but also provides flexibility for sellers, making it easier to transition without feeling tethered to current low mortgage rates.

The Fed's decisions, though indirect, reverberate in the mortgage rate landscape. By opting not to raise the Federal Funds Rate, the likelihood of continued declines in mortgage rates becomes more apparent. Rely on a reliable real estate professional who can offer knowledgeable guidance catered to the evolving housing market to successfully navigate these market challenges.

Stay up to date on the latest real estate trends.

preforeclosure

October 14, 2025

Discover your best options to protect your credit, preserve equity, and close fast with Florostone Realty.

preforeclosure

October 9, 2025

Discover how to buy a pre-foreclosure home in New Jersey

preforeclosure

October 7, 2025

Learn what pre-foreclosure means, how the process works in New Jersey

Divorce

October 2, 2025

Get local guidance for selling your home during divorce in NJ

Divorce

September 30, 2025

How to handle the feelings that come with selling your marital home in a divorce

Divorce

September 25, 2025

Supportive strategies for New Jersey couples navigating property division without financial loss

Divorce

September 23, 2025

A Certified Divorce Realtor’s Guide to Selling Your Home Fairly and Smoothly in New Jersey

Probate

September 18, 2025

Understanding probate timelines in New Jersey and how a Certified Probate Specialist can help you navigate the process.

Probate

September 16, 2025

Why choosing a Certified Probate Specialist in New Jersey can protect your family’s estate and make selling a probate home easier.

We strive to become your go-to Real Estate Advisors. Book a free consultation today and let’s get started with a buying or selling plan for your home customized to your unique timeline.