Why Have More People Decided To Sell Their Homes Recently?

Oriana Suarez November 1, 2024

Buyers

Oriana Suarez November 1, 2024

Buyers

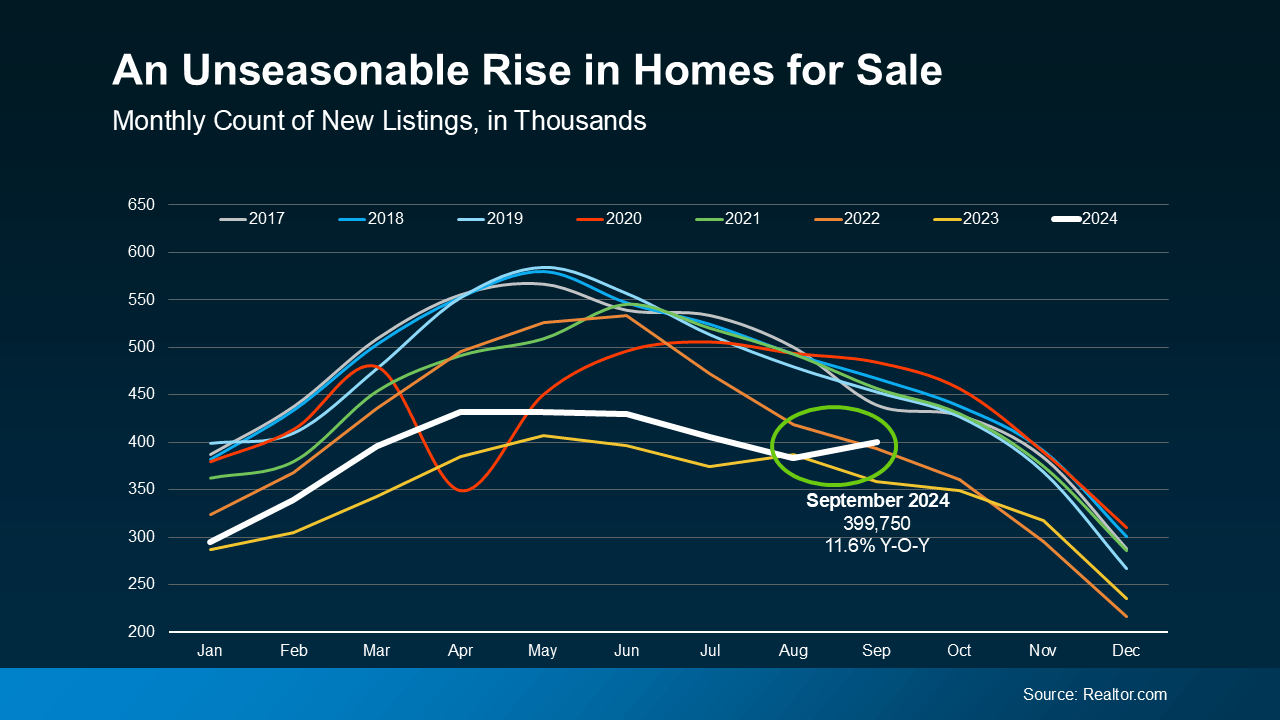

Homeowners typically slow down their moving plans as the summer months wrap up, so fewer homes are listed for sale in the fall. It’s a predictable, seasonal trend in real estate. But this year, mortgage rates came down, and at the same time, the number of homes on the market usually started to decline. So, what happened? More homeowners decided to sell, so more homes came to the market.

The most recent data from Realtor.com reveals that in September, the number of homes put up for sale increased by 11.6% compared to this time last year.

As the green circle in the graph below shows, the typical September decline in homes coming to the market didn’t happen – that number went up (see graph below):

Ralph McLaughlin, Senior Economist at Realtor.com, explains why there was an unseasonable rise:

Ralph McLaughlin, Senior Economist at Realtor.com, explains why there was an unseasonable rise:

“This sharp increase is largely due to the decline in mortgage rates in mid-August, enticing homeowners to sell.”

So, as rates came down at the end of the summer, more people jumped into the market and decided to make their move.

It means more fresh options to choose from than you’ve had in a while – not the ones that have been sitting around, unsold.

But keep in mind, that mortgage rates have been volatile lately, ticking up slightly in recent weeks, which could limit the number of people who feel comfortable with the idea of selling in the months ahead. And in this market, it’s mortgage rates that are largely driving homeowner decisions.

Whether you're looking for a starter home, an upgrade, or hoping to downsize, you have more homes to choose from right now. And if you can find what you’re looking for, know that these new, fresh options won’t be on the market forever. So, staying on top of what’s available in your local area with a trusted agent is key.

And remember, one month doesn’t make a trend. So, what does that mean going forward? Whether more homeowners than normal continue to put their houses on the market will largely depend on what happens with mortgage rates and the economic factors that impact them, like inflation, employment, and the reactions by the Federal Reserve.

With that in mind, now might be your moment, while more homes are available – if you’re ready, willing, and able to buy this fall.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“The rise in inventory – and, more technically, the accompanying months’ supply – implies home buyers are in a much-improved position to find the right home and at more favorable prices.”

As rates came down at the end of the summer, sellers started to trickle back into the market, which means buyers have more choices right now. Let’s connect to make sure you have a trusted advisor to help you navigate the new options before they’re all scooped up.

(908) 445-5339 | [email protected]

Stay up to date on the latest real estate trends.

Divorce

February 25, 2026

A guide to property division, your real estate options, and how to protect your equity

Tips

February 25, 2026

What buyers, sellers, and agents need to know this year

preforeclosure

October 14, 2025

Discover your best options to protect your credit, preserve equity, and close fast with Florostone Realty.

preforeclosure

October 9, 2025

Discover how to buy a pre-foreclosure home in New Jersey

preforeclosure

October 7, 2025

Learn what pre-foreclosure means, how the process works in New Jersey

Divorce

October 2, 2025

Get local guidance for selling your home during divorce in NJ

Divorce

September 30, 2025

How to handle the feelings that come with selling your marital home in a divorce

Divorce

September 25, 2025

Supportive strategies for New Jersey couples navigating property division without financial loss

Divorce

September 23, 2025

A Certified Divorce Realtor’s Guide to Selling Your Home Fairly and Smoothly in New Jersey

We strive to become your go-to Real Estate Advisors. Book a free consultation today and let’s get started with a buying or selling plan for your home customized to your unique timeline.